Small Business-Led Cosmetics Export Becomes One of Korea’s Top 10 Export Items

K-Consumer Goods Achieve Record Success Alongside Hallyu Expansion… Targeting $70 Billion by 2030

The Korean cosmetics industry continues to achieve astonishing results on the global stage. As cosmetics exports officially join the ranks as a ‘leading industry’ in 2025, there is growing interest in the synergy created by the joint growth of small businesses and Hallyu content.

K-Consumer Goods Exports Exceed $42.2 Billion… Cosmetics Outsell Electric Vehicles

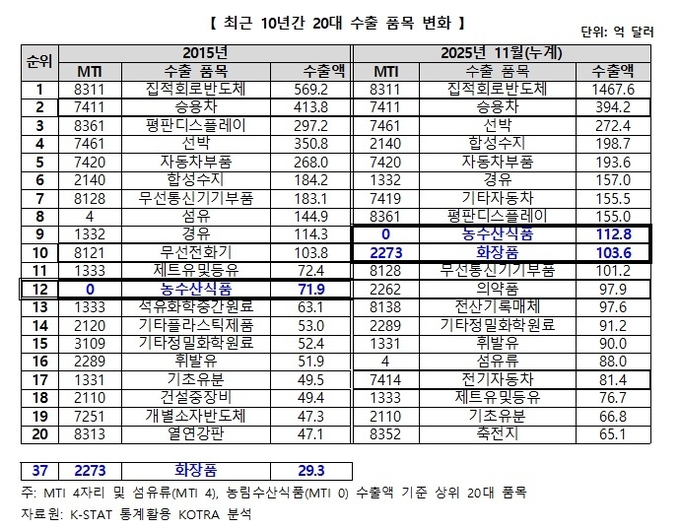

Korean cosmetics overtook electric vehicles and secondary batteries to proudly secure a spot among Korea’s ‘Top 10 Export Items’ in 2025.

By November 2025, the accumulated total export value of Korea’s top 5 consumer goods (including cosmetics, agricultural and marine products) reached $42.2 billion, and is expected to easily surpass the previous year’s achievement of $42.7 billion by the end of December. Specifically, cosmetics increased by 11.4% to $10.4 billion, and agricultural and marine products rose by 6.5% to $11.3 billion, leading K-consumer goods exports.

“With cosmetics emerging as the leading player in K-consumer goods, both they and food have exceeded $10 billion in exports for two consecutive years.”

A notable point is that the export structure, which was once centered on large corporations, has shifted to being led by small businesses. For cosmetics, the proportion of small and medium enterprises rose sharply to 91.1% of total export value, with agricultural and marine products also exceeding 83%. This not only broadens export growth but also reflects the effectiveness of new market strategies.

Cosmetics Export Nations Expand from 4 to 19 Countries, Landscape Changed in 10 Years

Just a decade ago, there were only 4 countries where annual cosmetics exports exceeded $100 million, but this has now significantly expanded to 19 countries. The agricultural and marine products sector increased from 13 countries to 17 over the same period.

This transformation is underpinned by an export diversification strategy. By reducing dependency on specific markets and establishing new trade routes, the supply chain has been strengthened and global brand competitiveness improved.

“In 2025, the top 5 consumer goods accounted for 6.6% of total exports, with expectations to break the 10% mark in the future.”

This reflects a shift in the export structure from being centered on materials and intermediate goods to focusing on consumer goods.

The Acceleration of Hallyu Heads to the Middle East and Global South

The influence of Hallyu content extends beyond just cultural spread, translating into tangible export results.

With increased interest and trust in Korea through K-pop and K-dramas, attention has shifted to everyday consumer goods—especially products used daily like cosmetics and food. This trend is even more evident in the Middle East and Global South.

By November 2025, the increase in exports to major Middle Eastern countries was impressive. In the UAE, cosmetics exports grew by 66% and agricultural and marine products by 39% compared to the previous year, while Türkiye saw increases of 24% and 66%, respectively. Additionally, rising brand recognition is accelerating growth in emerging markets such as Taiwan, Saudi Arabia, and Nigeria.

Marketing Linked with Hallyu and Industry… Expanding the Overseas Presence

Export growth is accompanied by aggressive local marketing beyond mere distribution expansion.

Kotra is strengthening marketing that links content and consumer goods. Hallyu Expos held in strategic regions like Almaty, New York, and Kuala Lumpur have become opportunities for direct brand promotion and to widen touchpoints with local consumers.

“The structure converting culture-based demand into industrial profit is becoming more established.”

Additionally, efforts are underway to build logistics centers dedicated to K-consumer goods, expand cooperation with online distribution networks, and support joint certification among domestic and foreign companies through multifaceted industry-culture strategies.

Government Introduces Roadmap to Achieve $70 Billion Export Target

On December 24, 2025, a ‘Consumer Goods Export Expansion Plan’ containing long-term strategies was announced.

The government aims to expand K-consumer goods exports to $70 billion by 2030, strengthening culture-industry convergence marketing overseas along with logistics, certification, and distribution support. Cultivating K-brand star companies is also a central pillar of the roadmap.

This will be phased in so it can be felt in the export field, with the fusion of K-content and products expected to secure market sustainability.

Development of K-Consumer Goods is an Industrial Innovation Trend, Not Just a Fad

The analysis that industrial innovation, rather than short-term popularity or boom, is driving K-consumer goods exports is gaining traction.

As of 2025, Korea’s total exports have increased by about 1.3 times compared to a decade ago, while cosmetics exports have surged by 3.9 times. This is an indicator that the industrial structure is shifting towards high-value-added consumer goods.

“Going forward, K-consumer goods can be expected to continuously expand through industry-culture convergence, small business-centered strategies, and regional diversification.”

This holds significance beyond mere export performance numbers.

From White Label to Global Brands… The Challenge of Small Businesses

The Korean cosmetics industry, once driven by OEM methods, is now shifting towards entering the global market with direct branding.

The challenge spirit and nimble planning skills of small businesses are key drivers for creating new opportunities. In the past 1-2 years, there has been a noticeable increase in consumers looking for Korean cosmetic brands in North American and European regions, accompanied by the accumulation of local market penetration know-how.

Small brands emerging with Hallyu are evaluated as having a sufficient possibility of becoming mainstream in global distribution channels before long.

‘Korea Buying’ to ‘World Buying Korea’

Previously, it was common to see foreigners purchasing products in Korea, but now it is an era where the world directly buys Korean cosmetics in their markets or local stores.

This has been made possible by online distribution power, conjoint growth with cultural content, accumulated brand trust over time, and flexible strategies of small businesses.

The key question now is the extent to which this trend can be maintained and evolved beyond next year.

In Closing

Korean cosmetics exports are not just experiencing numerical growth but are also leading to qualitative growth driven by small businesses and a restructuring of the industry. The cultural influence of Hallyu combined with meticulous export strategies has produced these results, and there’s great potential for continued sustainability.

Considering the current state and future vision of cosmetics exports, stands as a reliable partner in this field. We look forward to contributing to building a solid global foundation for K-consumer goods and enabling sustainable growth with .